- December 13, 2025

-

-

Loading

Loading

Officials in the city of Winter Garden approved unanimously the final budget for Fiscal Year 2023-24 Thursday, Sept. 26, at City Hall.

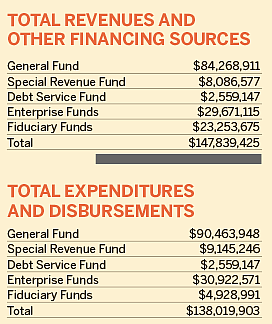

City commissioners voted to set the budget at $138,019,903 with a millage rate of 4.5.

The millage rate is greater than the rolled-back rate of 4.0908 mills by 10%.

In a budget message in the final budget report, City Manager Jon C. Williams said this fiscal year presents the city with both opportunities and challenges.

“Our primary goal is to continue fostering the growth and well-being of our community while ensuring responsible fiscal management,” he said. “This budget proposal aims to strike a balance between the provision of essential services, targeted investments and prudent financial planning. This budget is a culmination of extensive analysis, careful consideration and the shared vision of our community.”

As far as an economic outlook, Williams said the city experienced welcomed economic growth as key economic indicators continued to move in a positive direction.

“Revenue projections are strong due to increased real-estate valuations, new construction and consumer spending,” he said. “The city also boasts a healthy General Fund reserve of $17.4 million, or 31% of the General Fund operating expenditures. Economists predict a mild recession is anticipated sometime in the next 12 months, but our healthy financial reserves will help us navigate unforeseen events ahead. The city’s financial status is strong and continues to grow, generating sufficient revenues to meet increased costs for quality municipal service delivery standards that our constituents have come to expect.”

INSIDE THE NUMBERS

Population estimates based on the University of Florida’s Bureau of Economic and Business Research placed Winter Garden population at 50,318 in FY 2022, representing a 13% increase over five years and 30% increase over 10 years.

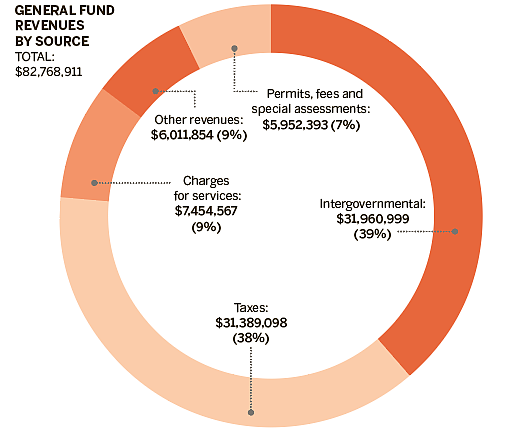

The General Fund budget revenues for FY 2023-24 totals $82,768,911. This is an increase of $13,920,535, or 63%, when compared to the budget for the prior fiscal year.

The most significant source of the increase in this year’s budget is from the addition of $24.5 million in grant funding. The funding consists of $18 million from the allocation of American Rescue Plan Act funds, $1.2 million from the firefighter Staffing for Adequate Fire and Emergency Response grant program and $5 million from the West Orange Healthcare District program.

The General Fund operating revenues, not including grant funding, increased 14.7% — $7.5 million — over last year’s budget.

The largest revenue source in the General Fund budget is ad valorem taxes in the amount of $24,081,464, which is based on the current millage.

Although the current rate is maintained, ad valorem property tax revenue will increase by $2,730,358 as a result of the 12.8% increase in Winter Garden’s property values.

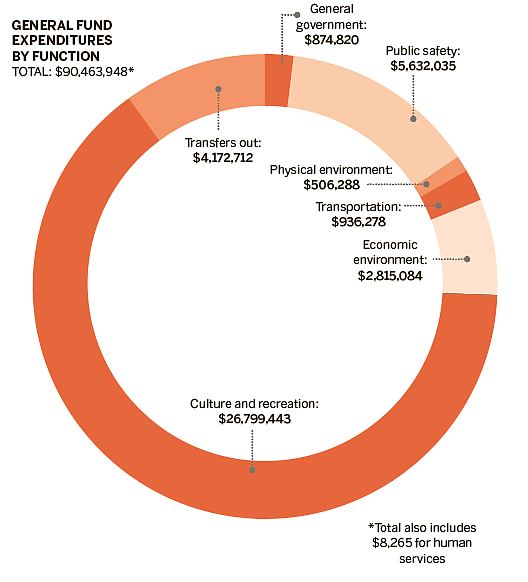

“We have funded the budget to ensure robust economic development and strong public safety,” Williams said. “The budget funds a commitment to meet the continued need for infrastructure improvements and provide high quality services to the residents, businesses and visitors of the city. Consequently, operating expenditures are expected to increase by about 13.6%, or $6.67 million, and the capital budget has increased by $31.7 million, with the majority of the new capital funded by grant and contributions funding.”

Williams said in addition to providing funding for essential governmental services, the city has been able to include funds to start addressing several other community projects with the use of grant funding and other sources of revenues.

These major initiatives include the Tucker Ranch Health and Wellness Park, the east Winter Garden revitalization and the city’s traffic management program.

Regarding long-term financial planning, Williams said the projected unassigned fund balance in the General Fund at the end of FY 2024 is budgeted to be $17,362,642, bringing the unassigned fund balance to 31.2% of General Fund operating expenditures.

“During the years when General Fund revenues increased at exponential rates, the city maintained the fiscal discipline to keep operating growth at a conservative level each year and moved the additional funds to capital investments, increased city services and savings,” he said. “Over the last decade, the city’s unassigned reserves as a percentage of reoccurring expenditures has continued to be above the goal of 30%. This balance will serve the city well if projected revenues are not met or if there are any unexpected expenditures that the city will have to pay for such as natural disaster recovery.”

William said the city is widely recognized as a well-planned community, successfully balancing the provision of exceptional levels of service, a welcoming business climate and an extensive array of amenities.

“We were able to maintain the quality standard of excellence thanks to our dedicated employees who work incredibly hard, day after day,” he said. “We continue to maintain a conservative budget by controlling costs without compromising the services that add value and serve the city well.”