- April 15, 2025

-

-

Loading

Loading

If you were to look up the word “chaos” in the thesaurus, you might just find “the 2021-2023 real-estate market” as a synonym.

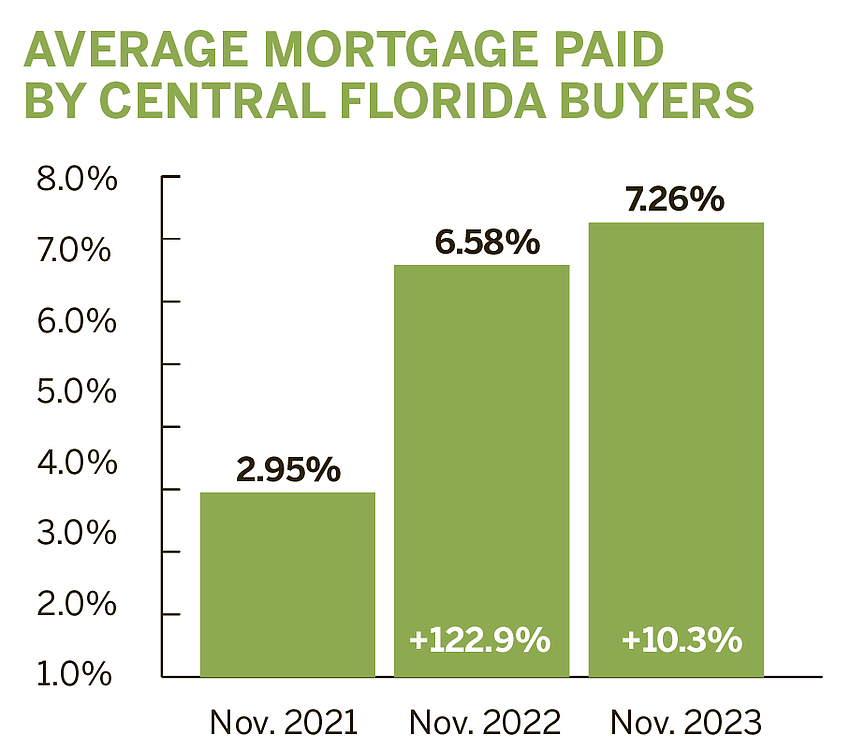

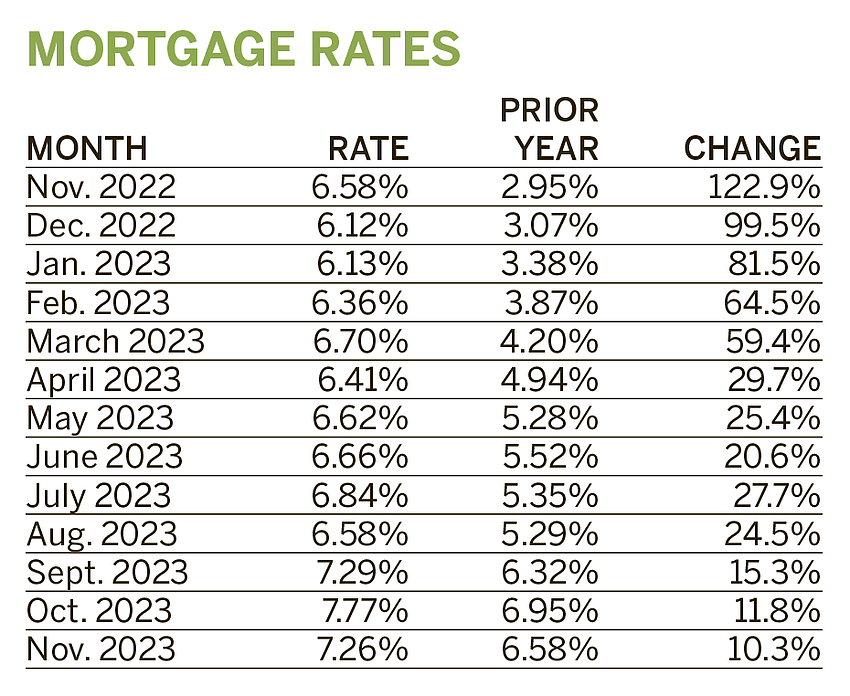

In two years, buyers and sellers saw mortgage interest rates change from 2.95% in November 2021 to a whopping 7.77% in October 2023.

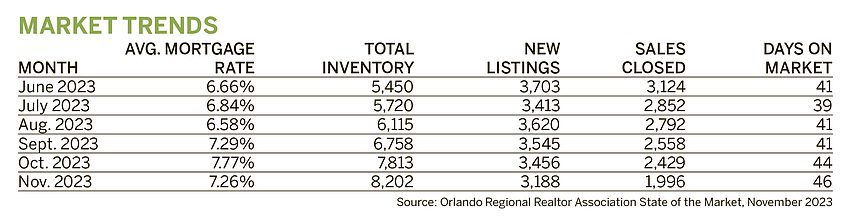

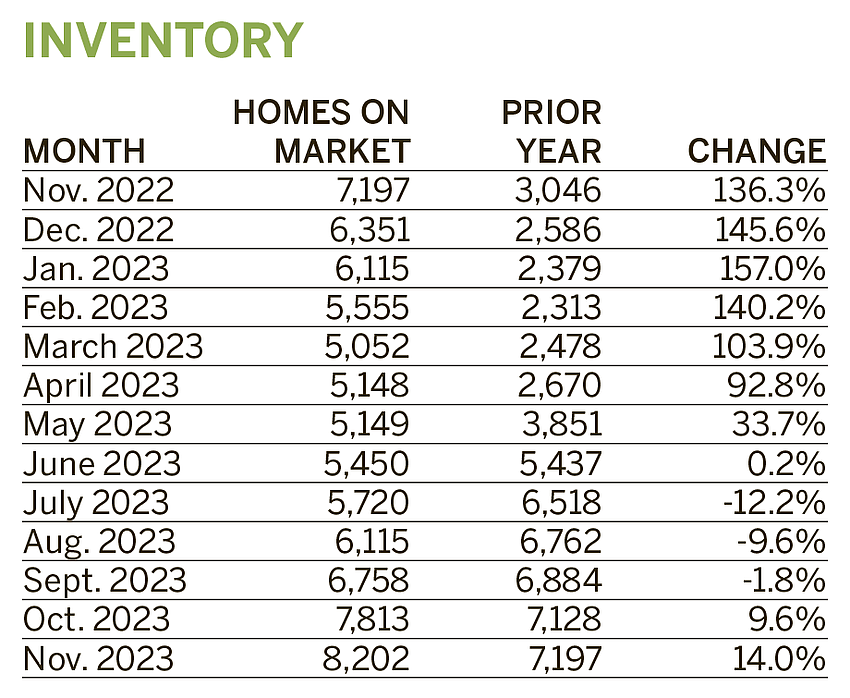

Accordingly, the Central Florida market experienced wild swings in inventory — going from a low of 2,313 in February 2021 to 8,202 in November 2023.

“The good news is that the increase in inventory helped the market a lot,” said Lisa Hill, immediate past president at Orlando Regional REALTOR Association. “We had no homes (on the market), and we’re starting to see the increase.”

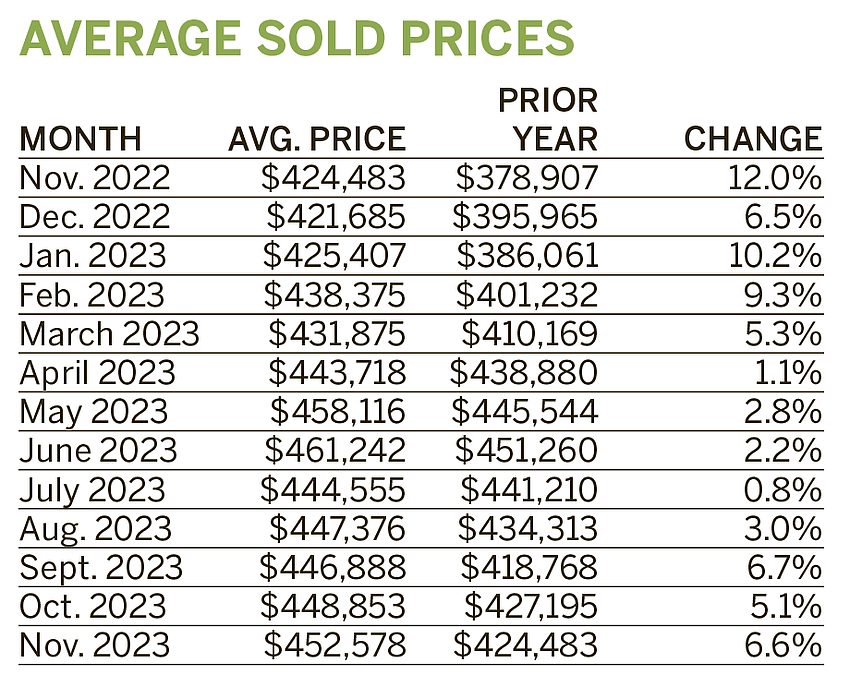

And yet, because of the area’s high demand — spurred by transplants from states such as California, New York and New Jersey, as well as a steady influx of international buyers from countries such as Brazil — average prices of homes continued to grow steadily — from $378,907 in November 2021 to $452,578 in November 2023.

However, given the tumultuous past two years — along with 2024 being an election year — local experts agree: For buyers and sellers to be successful this year, they will have to be smart, savvy and flexible.

BUYERS

In the fourth quarter of 2023, interest rates saw a slight decrease — from 7.77% in October to 7.26% in November to 7.22% in December, Hill said.

“To put that into perspective, for a $400,000 house, that’s $125 per month,” she said.

Hill expects that trend to continue in the first quarter of 2024, settling somewhere in the 6% to 6.5% range.

“Obviously, that depends on the Fed,” she said.

And while the skyrocketing interest rates certainly cooled the market in 2023, it also helped to increase inventory and lengthen a home’s time on market — both positives for those searching for a home to buy. Furthermore, Hill advises her clients to consider more than just the mortgage rate. After all, refinancing to a lower rate is an option post-sale.

“Marry the house, date the rate,” she said.

Matthew Allen, a Windermere-based agent who leads the Matt Allen Team, agrees and said for anyone looking to purchase his or her first home and begin to build equity, it is paramount to find a way to get on the property-ownership ladder. Admittedly, that is difficult in the Central Florida market, where the average starter home in Orange County costs a whopping $500,000.

Difficult, yes. But not impossible, Allen said.

“Start talking to lenders early,” he said. “Do your research to get the best rates, and some even help with closing costs.”

There are myriad assistance programs available to first-time homebuyers that can assist with down payments. Furthermore, experts say buyers would be wise to widen their search parameters. Many builders are offering interest rate buy-down incentives for new construction, he said.

The key is to know your options and to stay flexible.

“Explore your options,” Hill said. “Look at single-family (homes) versus townhouses. Look at all your scenarios. There’s nothing we can do about the interest rate (right now), but you can refinance down the road.

“(For first-time buyers), don’t look for your forever home,” she said. “Statistically, people are in their first home for five years and then move on.”

Home prices rose throughout 2023, and experts expect that to continue in 2024. Demand from out-of-state buyers remains high, and with Universal’s Epic Universe slated to open in 2025, the West Orange and Southwest Orange markets will remain popular for those transplants, said Matt McKee, of the Dr. Phillips-based The Matt McKee Group — Compass.

And although a $500,000 starter home sounds outrageous to longtime Florida residents, for those moving from California, New York and New Jersey, it is quite reasonable.

“It’s still a very affordable state (comparatively),” Allen said. “The median California home is $1.4 million to $1.5 million. They like the cost. They like the weather. And they like the state government.”

International buyers also exert influence on the local market. Brazil, in particular, accounts for 38% of all international buyers, Hill said.

“It’s so affordable here (compared to Brazil,” she said. “They love the climate, and it’s a little safer here, too. They also love Disney; it’s all about The Mouse.”

SELLERS

The average time on market lengthened to a six-month high of 46 days in November 2023. Gone are the days when homeowners received phone calls and texts with sight-unseen offers from iBuyer companies such as Opendoor and Zillow. Gone, as well, are the buyers willing to waive inspections and appraisals to close as quickly as possible.

And that’s a good thing.

“This is the way it should be,” Hill said.

Yes, sellers: You are going to have to put in some effort.

“We went from seven days (to close) no problem in 2021 to 2022 to now, I tell my sellers to expect 120 (total) days (to close),” McKee said. “Your home has to be a show-ready model home. It’s not for the faint of heart. You cannot be a casual seller. You have to be fully engaged.”

Allen agreed and said that engagement starts even before the “for sale” sign is put in the front yard.

“Houses that sell the quickest are priced appropriately,” he said. “Know your comparables.”

Furthermore, take care of all that maintenance you’ve put off for years. Buyers don’t want to rehab a house.

Finally, marketing is key, Allen said.

“You have to build the story of your house,” he said. “And you have to get your house in front of the people interested in your house.”

WHAT’S NEXT?

Succinctly, nobody knows for sure.

But experts agree a drop in interest rates in 2024 could encourage healthy growth in the market — freeing up some homeowners to either upgrade or downsize. That would continue to increase the available homes on the market, which would help with the steady demand from folks seeking property in Central Florida. And because of sustained interest from out-of-state buyers, the local market is poised for another year of growth.